HGV levy to restart 1st August 2023

Pre-Covid every Heavy Goods Vehicle (HGV) that weighed more than 12 tonnes had to pay an HGV Levy to cover the costs of maintaining UK roads. The UK Government suspended the levy on August 1st, 2020, and that has lasted throughout the Covid19 pandemic up until now.

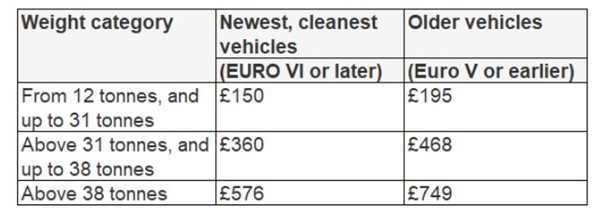

However, following the Spring Budget 2023, in which the UK Government confirmed that the HGV Levy consultation had concluded, it also confirmed that starting on August 1st, 2023, these fees would once again start to be levied against HGVs on UK roads, meaning that an HGV will need to pay between £150 and £749 per annum depending upon its weight and emissions banding, unless in one of the exemptions.

The HGV Road User Levy Act of 2013 established the tax, which went into effect on April 1, 2014. Since 2019 less polluting trucks have paid lower taxes, with payments collected by the DVLA.

The latest HGVs now emit 80 percent less nitrogen oxide (NOx) than older ones. As a result, vehicles that satisfy the most recent Euro 6 emissions criteria have been eligible for a 10% reduction in the cost of the HGV levy. While vehicles satisfying Euro Class V and older i.e. those introduced between January 2011 and September 2015 - must pay up to 20% more.

Earlier in 2022 the Department for Transport launched a consultation regarding the HGV Levy, seeking opinions on how it should be charged in the future, that consultation concluded on 18th July 2022.

The new 2023 HGV Levy is:

- Aligned to the environmental and air quality damage that the HGV causes, rather than the road wear and tear.

- No longer be related to the number of axis an HGV has but will use the weight of the HGV to approximate the carbon dioxide (CO2) emissions of the vehicle.

- Ensure that the levy liability is as closely aligned as possible with when a foreign vehicle is used on a major road.

HGV Levy Exemptions

There are five categories of vehicle that are exempt;

- Zero emission vehicles, not including hybrid vehicles.

- Showman fairground vehicles.

- Vehicles used on islands other than mainland UK.

- Vehicles that are used for instruction of learner drivers.

- HGV’s that are displaying temporary trade plates when travelling to a garage for maintenance.

The category for zero emissions was only announced on 1st August 2023, see HGV Levy exemptions.

Try our C02 savings calculator

Previously the HGV Levy included:

Previously the HGV Levy included 22 bands (eleven main bands, each divided into two emission class bands).

The New Levy from August 2023 onwards will consist of 3 bands each divided into two depending upon the CO2 class of the vehicle, to make a total of 6 charging bands, that will be applied equally to rigid HGVs, articulated and also rigid HGVs pulling trailers, and charges are understood to be as follows;

When these fees are imposed on top of already-inflated diesel fuel prices, road transport operators will face an additional expense per HGV that must now be absorbed or passed on to customers.

It will not be possible for fleets to easily and quickly swap out their older diesel-powered vehicles and have them replaced with newer, lower-emission replacements to reduce the levy fee. Therefore, companies should do all they can now to reduce the miles driven and optimise their road transport operations, increasing delivery density per vehicle and reducing cost per delivery.

Discover how delivery route scheduling can facilitate this.